- 3 minutes read

What to keep an eye on this Black Friday

Retailers need to ensure their omnichannel strategies are tight to capitalise on the biggest bargain hunting days of the year and the unofficial beginning of the Christmas shopping period.

Oscar Nieboer, Chief Marketing Officer, Paysafe Group, lends merchants some sound advice for meeting shoppers at the checkout with an experience they can't say no to.

With Black Friday (November 24) and Cyber Monday (November 27) fast approaching, retailers need to ensure their omnichannel strategies are tight to capitalise on the biggest bargain hunting days of the year and the unofficial beginning of the Christmas shopping period. Formerly a US-centric event, last year British consumers spent £5.8bn over the sales weekend – a 15 percent increase from the previous year, and this year, British shoppers are expected to nearly double their expenditure a predicted £10.1bn over the Black Friday weekend. In all, forecasts indicate that at least a quarter of all UK consumers plan to make a Black Friday or Cyber Monday purchase and 77 percent are expected to make these purchases online.

While Black Friday was traditionally an in-store event, technology has changed the way we shop and more and more retailers are now using e-commerce to launch their sales campaigns before they feature in their physical stores. This has the benefit of attracting a far wider audience. The expansion of e-commerce coupled with ever-growing smartphone usage has enabled the rise of “dual-browsing” with 41 percent of Brits now buying an item on a mobile phone while in-store. The rise of dual-browsing means perfecting the omnichannel experience is now more important than ever – retailers must make sure both the online and offline experiences are positive and hassle free. For example, online and offline deals need to have the same terms and conditions as a minimum.

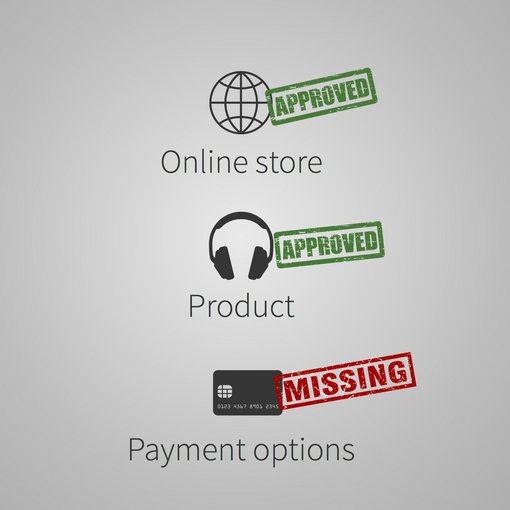

A key part of customer experience is the payment process. While it is often the last step in the transaction, it’s arguably amongst the most important. With the average Brit carrying £20 or less in their wallet, retailers should be aware of their customers’ preferred payment methods to avoid missing any crucial sales. The evolution of cash has led to more consumers adopting mobile wallets (24 percent) and cryptocurrencies (12 percent) for payments. While debit and credit cards remain king for consumers when making in-store purchases (51 percent), it is important for retailers to recognise the rise of alternative payment methods – both online and offline.

According to Paysafe data, a lack of payment options is one of the main reasons for online shoppers abandoning their baskets (20%). With so many new payment options now on offer, it can be daunting for retailers to pinpoint the right methods, but considering the cultural context and attitudes to security and authentication can be the difference between closing a successful sale, or losing out to a competitor.

Businesses need to wise up. Particularly during big retail events such as Black Friday and Cyber Monday, the likelihood is that consumers are browsing on various sites for the best deals on the items they are looking to buy, and with so many options available coupled with the consumer’s time-bound mindset, it’s crucial to for businesses to offer the right payments options.

Predominantly in the UK, where Black Friday isn’t a bank holiday as it is in the US, purchases are vastly made online. It is understanding these developments in purchasing trends and the subsequent evolution of customer preferences that truly gives merchants the power to capitalise on shopping events like these. In this respect, retailers need to be on top of their game when it comes to working with the right payment service providers who have the necessary expertise in this area and provide omnichannel solutions capable of anticipating change and ultimately helping merchants to thrive in a competitive environment.