- Four minutes read

Tracking the diversification of the online payment landscape

It has been clear for years that the future of online payments isn’t going to rely on a general consumer consensus focused on one, or even a handful of payment methods. Regional preferences have been a developing trend throughout global digital payments as eCommerce has evolved, but so too has been a general shift away dependency on card payments.

Card payments have always been the most popular payment method for consumers, and continue to be so today. But there are several reasons card payments alone will never be the preferred payment method for all consumers:

- New regulations such as Strong Customer authentication and the growth of Open Banking initiatives are making the user experience for some payments methods slicker than card payments, especially for mCommerce

- New payments methods such as crypto are gaining traction due to their specific characteristics including lower cross border payment fees

- There are new consumers paying online for the first time due to digitalisation of services that don’t trust sharing their financial details online. And even those that are experienced with online payments might not be uncomfortable sharing their financial data online

- Not all consumers have bank cards

Businesses understand this shift, and have been reacting to it. But the diversification of the payments landscape is accelerating more rapidly now than at any time previously. To discover more about how businesses are committing to a more diverse checkout, and their motivations, we commissioned a survey of over 900 businesses in eight countries for our latest research report Lost in Transaction: Finding competitive advantage at the checkout. Here are some of the key findings from the report.

How significant has COVID-19 been?

As we have already stated, the diversification of online checkouts is not a new trend, but is impossible to ignore how much COVID-19 has changed the landscape. That’s because 65% of businesses says that COVID-19 has changed consumer payment preferences. Specifically, they have seen many alternative payments methods increase in popularity. For example, 57% of businesses say they seen a greater percentage of payments in their online checkout being made by digital wallets; 39% have seen an increase in payments made by mobile wallets; 28% have seen an increase in eCash payments; and 15% have seen an increase in direct bank transfers.

With this is mind, it is not surprising that 63% of businesses say the pandemic has changed the way they think about accepting payments, and that 61% say COVID-19 has accelerated their plans to upgrade their checkout to satisfy increased consumer expectations.

Tracking businesses’ appetite for alternative payments

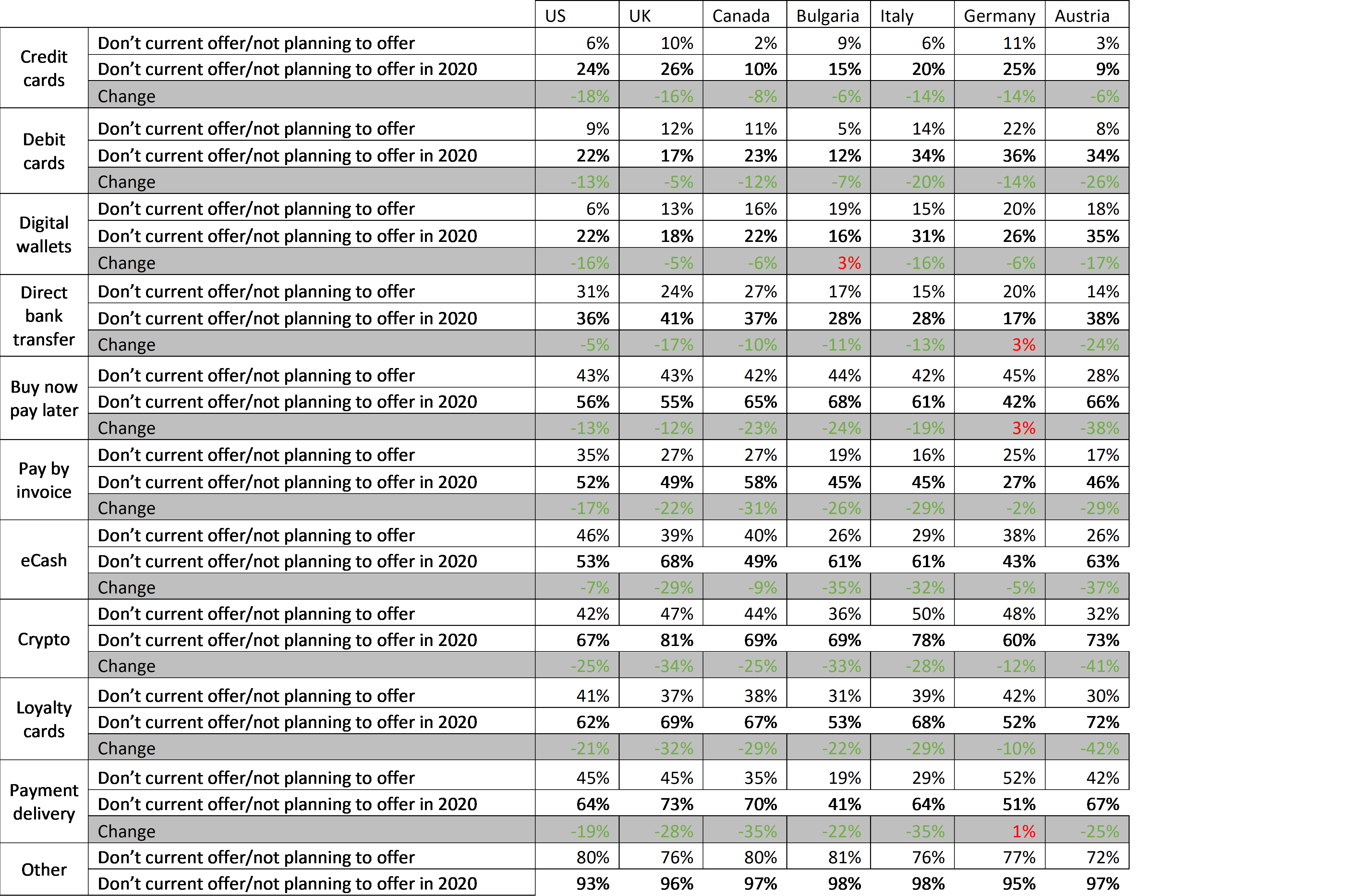

In 2020 we asked online businesses to tell us which payments methods they already offered, or planned to offer within the next two years. This year we asked businesses which payments methods they already offered or planned to offer within the next 12 months. When we compare the results, a clear pattern is visible.

Percentage of businesses that are not offering or planning to offer each payment method 2021 vs. 2020

For every single alterative payment method, the percentage of businesses not already offering or considering offering in their online checkout has fallen in the past 12 months, and that is also true for almost every payment method in every country. In some instances, such as crypto and eCash, the fall has been dramatic.

This demonstrates the change in attitude businesses have had to offering alternative payments in past 12 months; when businesses say that they are accelerating plans to overhaul their checkout, integrating new payment methods is clearly central to those plans.

The growth of crypto

One alternative payment method to highlight is cryptocurrencies, which looks set to be rapidly adopted as a payment method in 2022. Our research shows a firm commitment from businesses to bring crypto into their online checkouts, with almost half (48%) of businesses confirming it is a priority to do this as soon as possible. That is because over half (54%) of businesses already think that crypto is the future of payments, and 59% say adding crypto into their checkout will enable them to target new markets.

Expanding the checkout is a defensive as well as offensive move

But diversifying the checkout isn’t only about winning customers. Businesses are also facing some issues that they are tackling through offering more payment methods.

Chief among these is cart abandonments. 69% of businesses describe their level of cart abandonment as an issue, and one that is getting worse; 49% of businesses that have any cart abandonment in their checkout say it has increased in 2021.

When looking at the reason why this is happening, two of the major reasons cited by businesses is card declines and not being able to pay with their preferred payment method. Offering more alternatives to card payments can lessen the impact of these two factors.

Combatting rising fraud rates also on businesses’ agenda. Half (49%) of all businesses are more concerned about fraudulent transactions now than they were 12 months ago, and 41% have actively seen an increase in fraudulent transactions since the start of the pandemic. And the majority (59%) agree that having more payment methods available in the checkout is an effective strategy to reduce fraudulent transactions.

A year for evolution

So it is clear that the next 12 months we will continue to see businesses commit to expanding the payment methods offered in their online checkout, and to work with an even greater intensity to bring choice to their consumers.

Working with payments partners that can bring this range of payment methods through a single partnership and API will be crucial to making these ambitions become reality.

Lost in Transaction: Finding competitive advantage at the checkout is available to download now.